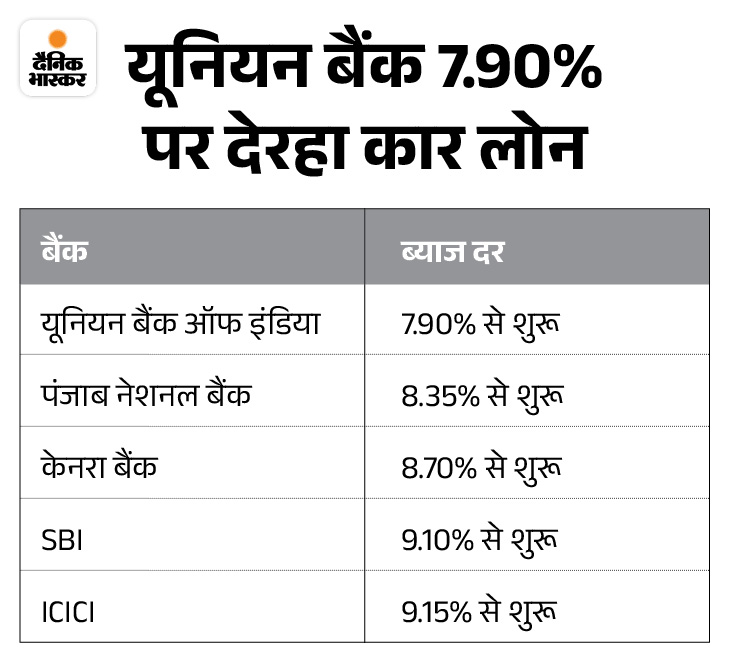

Union Bank offers car loans at 7.90% in 2025

These days, if you are planning to take a car and want to take a loan for it, then first of all it is important to know which interest rate is giving loan. State Bank of India i.e. SBI is currently giving car loan at 9.10% annual interest. At the same time, the interest rate of Union Bank of India starts at 7.90%.

We are telling you that at what interest rates the major banks of the country are giving car loans …

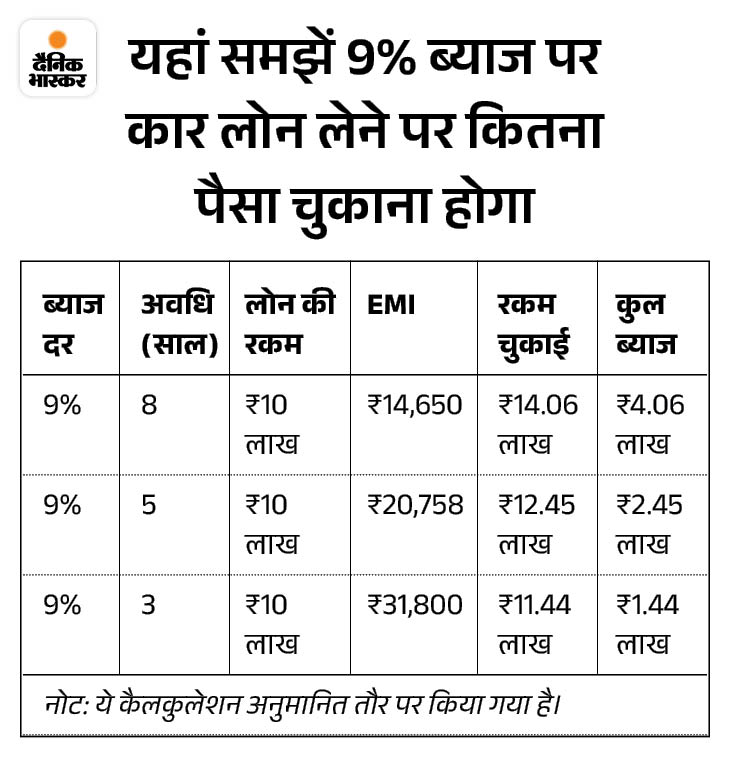

More interest has to be paid on taking a loan for a long time The loan should be taken for as soon as possible, the loan should not be pulled too long. Usually the car loan can be taken for a maximum of 8 years, but for a long time, ie for 7 to 8 years, you are given a loan at a higher interest rate. These interest rates can be up to 0.50% above the interest rate of loan with less time (3 to 4 years).

Loan interest rate also depends on credit score Car loan interest rate also depends on your credit score. If the credit score is good then there is a possibility of getting a loan at an easily and low interest rate. Apart from this, banks usually give loans at low interest rates to regular income sources. Keep these 3 things in mind while taking a loan

1. Note the pre -closure penalty While taking a car loan, you should check that the bank you are taking loans takes pre-close penalty. Pre closing means payment of loan amount before the tenure. Penalty rates are not the same for all banks. Therefore, choose the bank thoughtfully. Consider banks that either do not take penalty or charge very little amount.

2. Check processing fees Almost every bank takes a certain amount to process car loan applications. Sometimes it is also seen that, where some banks and agencies offer car loans at low interest rates, but they charge a lot of processing fees while giving loans. Therefore, before the loan lane, one should find out from the bank how much processing fees they will take to process the loan.

3. Special offers and Schemes Most banks offer special offers on car loans during the festive season or a certain period of year. Such offers should be taken advantage of. These offers include processing fees and pre-close penalty, 100% funding on vehicle, low or 0% interest rate, special gift voucher etc. People who have good credit profiles can get the best deal.